VAT in the Digital Age (ViDA)

Keep track of the legislative package that embraces digitalization and modernizes and improves the EU VAT system

This Tax Dossier was last reviewed on 29 January 2026

Outline Tax Dossier

Click the section of your interest or simply scroll down

- What is ViDA?

- Timelines

- Latest News Reports

- Latest Journal Articles and Opinion Pieces

- First Pillar: Digital Reporting Requirements

- Second Pillar: VAT Treatment of the Pillar Economy

- Third Pillar: Single VAT Registration

- Background

What is ViDA?

VAT in the Digital Age (ViDA) is a legislative package (the Package) introduced with the aim of modernizing the VAT system of the European Union, combating VAT fraud and addressing the challenges of the platform economy.

In particular, the Package entails three Pillars, which relate to three key areas:

- First Pillar: Digital reporting requirements: making mandatory electronic invoicing (e-invoicing) and introducing real-time digital reporting for cross-border trade to help reduce the VAT gap through more effective fraud detection and prevention.

- Second Pillar: VAT treatment of the platform economy: introducing the deemed supplier scheme for online platforms that facilitate short-term accommodation and passenger transport services.

- Third Pillar: Single VAT registration: extending the One Stop Shop (OSS) and the Import One Stop Shop (IOSS) to avoid multiple VAT registrations within the European Union.

The Package includes amendments to the following VAT legal documents:

- Directive 2006/112/EC on the common system of value added tax (the VAT Directive);

- Implementing Regulation 282/2011 laying down implementing measures for Directive 2006/112/EC on the common system of value added tax (the VAT Implementing Regulation); and

- Regulation 904/2010 on administrative cooperation and combating fraud in the field of value added tax (the Regulation).

The Package was adopted by the Council of the European Union (EU) on 11 March 2025. It was published in the Official Journal of the European Union (OJEU) on 25 March 2025 and came into force on 14 April 2025. Some amendments will be rolled out progressively until 2035 (see section Timelines).

ViDA legal documents in force (as from 2025)

- Council Directive (EU) 2025/516 of 11 March 2025 amending Directive 2006/112/EC as regards VAT rules for the digital age (25 March 2025)

- Council Implementing Regulation (EU) 2025/518 of 11 March 2025 amending Implementing Regulation (EU) No 282/2011 as regards information requirements for certain VAT schemes (25 March 2025)

- Council Regulation (EU) 2025/517 of 11 March 2025 amending Regulation (EU) No 904/2010 as regards the VAT administrative cooperation arrangements needed for the digital age (25 March 2025)

Timelines

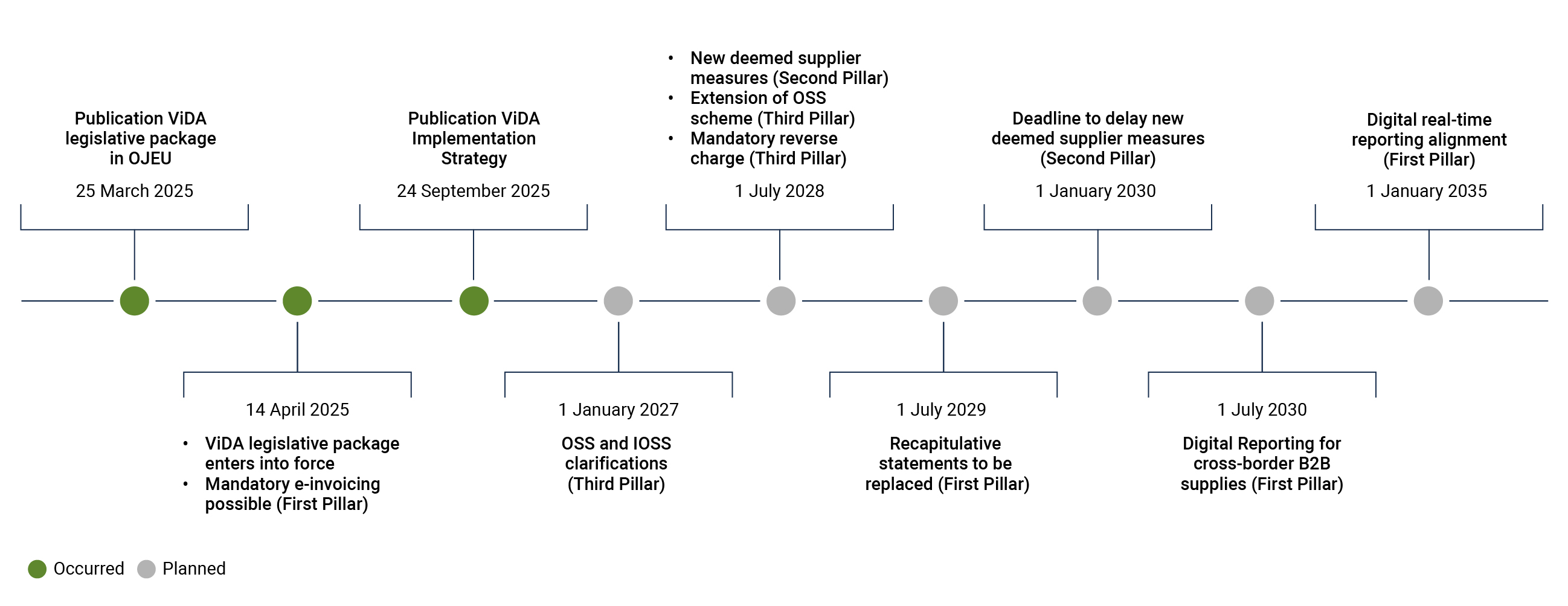

Implementation of the ViDA Legislative Package (2025-2035)

This timeline shows the progressive implementation of the Package and the different dates on which the amendments enter into force (upon the Pillars), starting in 2025 and extending until 2035:

* This timeline does not indicate the implementation dates for each Member State, which may vary.

** The implementation of the amendments to Regulation 904/2010 as regards the VAT administrative cooperation arrangements needed for the digital age are in line with the implementation of the Pillars.

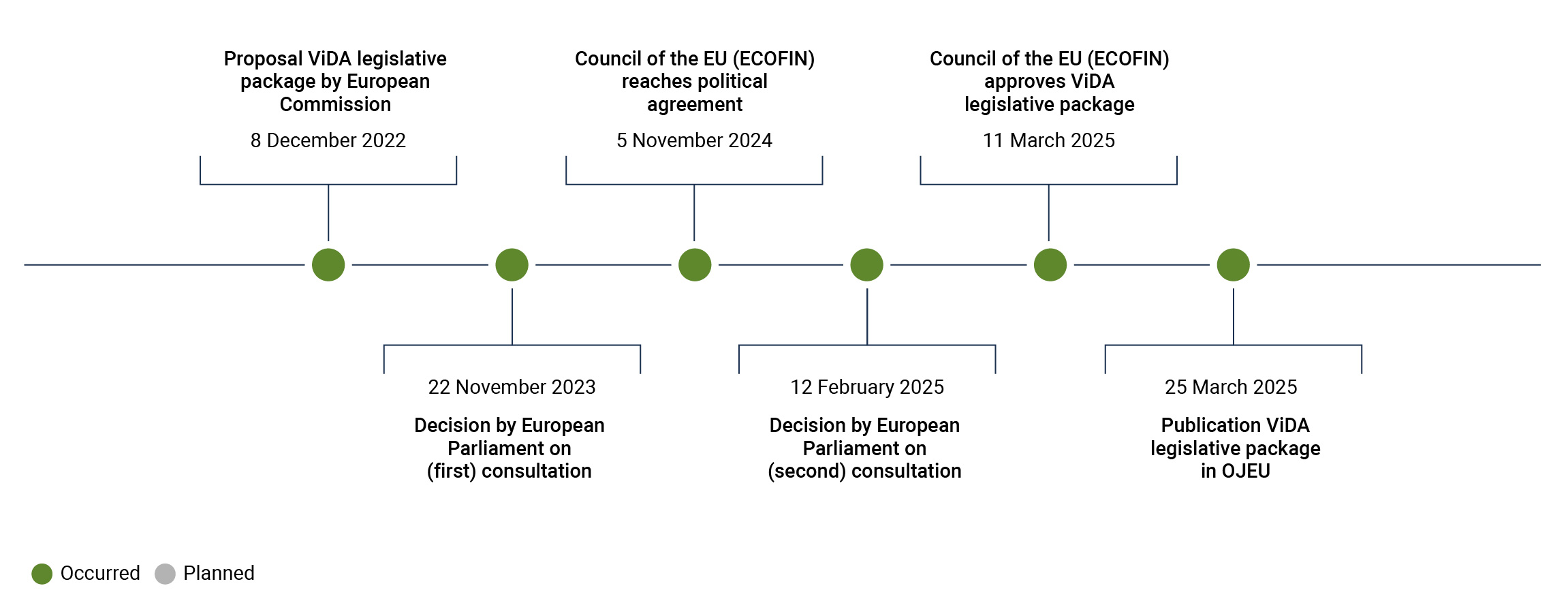

Legislative Procedure of ViDA Legislative Package (2022-2025)

This timeline outlines the legislative procedure of the Package, starting with the proposal made by the European Commission on 8 December 2022 and ending with its publication in the OJEU on 25 March 2025:

Latest News Reports

- European Union - ECOFIN Report Confirms VAT Legislative Progress; Energy, Tobacco Reforms Remain Under Discussion (16 December 2025)

- Lithuania - Government Submits Draft Law Implementing First Stage of EU's ViDA Package (4 December 2025)

- Spain; European Union - Tax Authority Consults on Draft Law to Partially Transpose EU's ViDA Rules (5 December 2025)

- European Union - Group on Future of VAT Publishes Minutes of 50th Meeting Addressing ViDA Implementation and Travel and Tourism Package (21 November 2025)

- European Union - VAT Expert Group Publishes Minutes of 41st Meeting Addressing Updates on ViDA Implementation and Future VAT Reforms (21 November 2025)

- European Union - VAT Expert Group Releases Agenda of 41st Meeting Addressing VAT in Digital Age (ViDA) Implementation Strategy (18 November 2025)

- European Union - Group on Future of VAT Publishes Agenda of 50th Meeting Addressing VAT in Digital Age (ViDA) Implementation, Platform Economy (3 November 2025)

- European Union - European Commission Holds Implementation Dialogue on VAT in Digital Age (ViDA) Package with Business Stakeholders (31 October 2025)

- European Commission Identifies IT Readiness and Divergent National Approaches as Key Obstacles to VAT in Digital Age (ViDA) Implementation (25 September 2025)

- Working Party on Tax Questions to Address VAT Priorities, EU-Norway Administrative Cooperation Agreement and Customs Reform (27 August 2025)

Latest Journal Articles and Opinion Pieces

- Questioning the Proportionality of the ViDA Rules on the Platform Economy: Are We Veering Off Course? (10 May 2024)

Marta Papis & Emilia Teresa Sroka

- Digitalization of VAT Reporting in Poland (7 November 2023)

Krzysztof Lasiński-Sulecki

- European Union - The Increasing Liability of Digital Platforms in the Collection of EU VAT (12 June 2023)

Fernando Matesanz

- European Union - EU VAT in the Digital Age (20 January 2023)

Patrick Wille

First Pillar: Digital Reporting Requirements

The first Pillar implements a real-time reporting system (transaction-by-transaction basis) based on e-invoicing, which is the default invoicing method mandating a standardized content of information to be reported. This Pillar intends to achieve interoperability of the systems, reduce obstacles to cross-border businesses and fight VAT fraud.

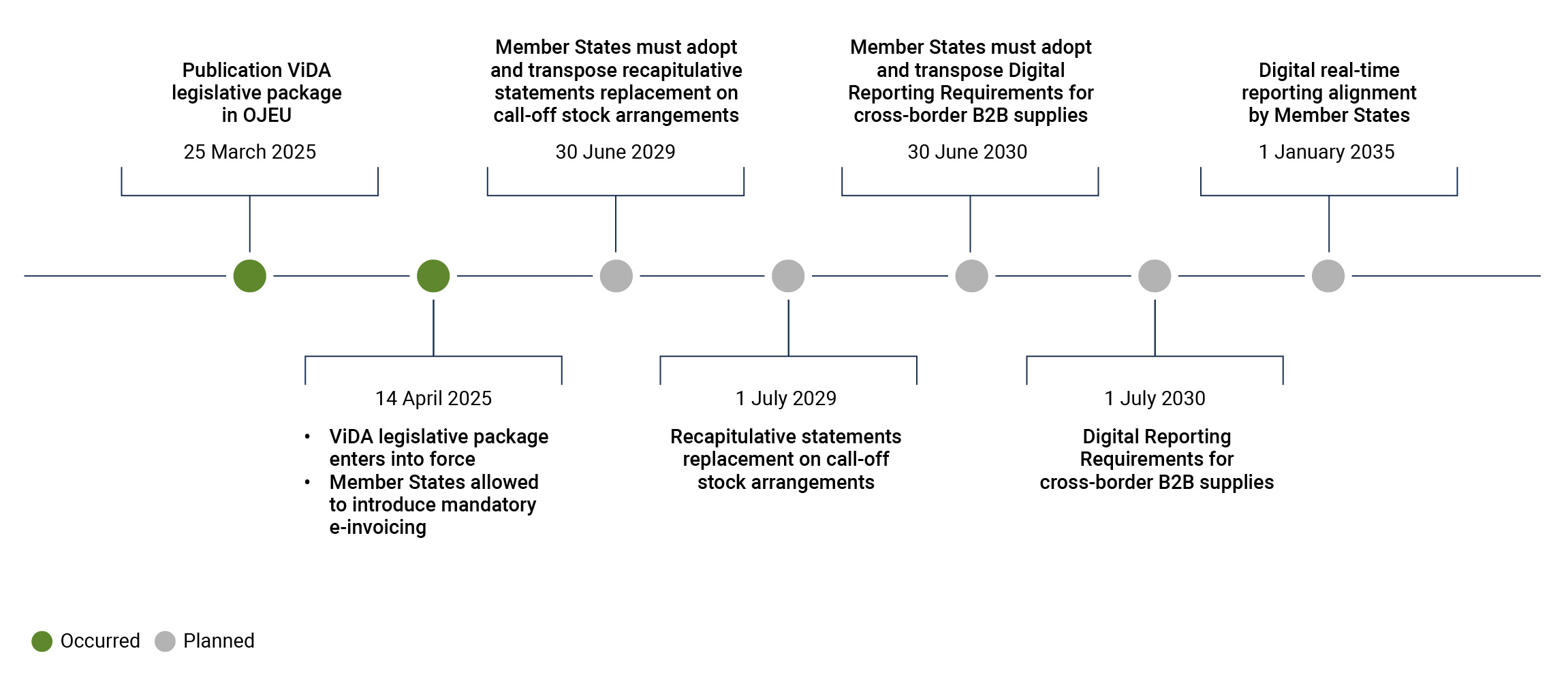

First Pillar Timeline

* This timeline does not indicate the implementation dates for each Member State, which may vary.

First Pillar Latest Journal Articles and Opinion Pieces

- European Union - Is ViDA a Diva Deserving a Big Applause from 37.5 Million Unpaid Tax Collectors? (30 November 2023)

Ine Lejeune

Christian Amand

- European Union - Proposal for a Secure Digital Reporting Standard for Intra-Community Transactions (27 October 2022)

Sascha Jafari, Marie Lamensch and Marta Papis-Almansa

Second Pillar: VAT Treatment of the Pillar Economy

The second Pillar targets online platforms in the passenger transport and short-term accommodation rental sectors, which allow persons acting in their individual capacity or small businesses, generally exempt from the obligation to register and charge VAT, to connect to a large number of consumers. With the adoption of the ViDA package, platform economy operators in the referred-to sectors are responsible for collecting and remitting VAT to tax authorities where the underlying supplier does not charge VAT.

Due to the possibility of accessing a wide consumer base, this business model (online platforms) puts small service providers in direct competition with traditional business operators that qualify as taxable persons for VAT purposes, thereby creating a distortion of competition. This measure aims to contribute to a more level playing field between online and traditional services.

Second Pillar Timeline

* This timeline does not indicate the implementation dates for each Member State, which may vary.

Second Pillar Latest Journal Articles and Opinion Pieces

- European Union - Questioning the Proportionality of the ViDA Rules on the Platform Economy: Are We Veering off Course? (10 May 2024)

Marta Papis-Almansa and Emilia Teresa Sroka

Javier Sánchez Gallardo and Gorka Echevarria

Third Pillar: Single VAT Registration

The third Pillar expands and enhances the existing OSS and IOSS schemes (e-commerce rules introduced on 1 July 2021) to include in their scope some supplies that are currently excluded and allow even more businesses to fulfil their VAT compliance obligations via a single online portal and in one language. In this sense, this Pillar facilitates the registration for VAT purposes in one EU Member State when businesses operate across different Member States by removing the need for businesses to register twice or multiple times for VAT purposes when they want to sell goods to consumers within a Member State other than their own.

Third Pillar Timeline

* This timeline does not indicate the implementation dates for each Member State, which may vary.

Third Pillar Latest Journal Articles and Opinion Pieces

- European Union - An EU Single VAT Registration on B2B Supplies (22 March 2021)

Christian Amand and Emanuele Ceci

Background

The EU VAT system for intra-Community trade remained unchanged for nearly 30 years. Despite some improvements, it was still not adapted to technological advances or new business models. This led to some intra-Community VAT fraud and evasion, contributing to the EU VAT gap, which, for 2022, was estimated at EUR 89 billion.

Considering that VAT is one of the most important revenue streams for Member State tax authorities and given the need to improve VAT collection and simplify cross-border compliance, the ViDA package was adopted, leveraging the development of digital technology by incorporating digital tools that enhance transparency and reduce opportunities for fraud.

The ViDA package includes measures such as real-time reporting, harmonization of VAT rules across Member States and improved cooperation between national tax authorities. By addressing the shortcomings of the previous system, the ViDA package seeks to reduce the EU VAT gap and ensure a fairer and more efficient tax environment for businesses operating within the European Union. These reforms are expected to bolster the integrity of intra-Community trade and support the European Union's economic growth.

ViDA Legal Proposals (2022)

- Proposal for a Council Directive amending Directive 2006/112/EC as regards VAT rules for the digital age (8 December 2022)

- Proposal for a Council Implementing Regulation amending Implementing Regulation (EU) No 282/2011 as regards information requirements for certain VAT schemes (8 December 2022)

- Proposal for a Council Regulation amending Regulation (EU) No. 904/2010 as regards the VAT administrative cooperation arrangements needed for the digital age (8 December 2022)